54+ can you deduct mortgage interest on a rental property

Instead these expenses are added to your basis in the. Web Yes if you receive rental income from a property you are entitled to deduct certain expenses including mortgage interest property tax operating expenses.

Is Your Mortgage Considered An Expense For Rental Property

Many other settlement fees and closing costs for.

. Web The amount of mortgage interest you can deduct depends on the type of home loan you have and the way you file your taxes. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. It permits you to deduct the interest on up to.

Homeowners who bought houses before December 16. Web If you take out a 2000000 mortgage against a rental property that includes 1300000 in traditional mortgage debt and a 700000 cash-out portion you. Yes you would only enter the balance.

Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. Web Do I report Mortgage interest for Rental Property as rental expense or an itemized deduction. Ad Our team of tax experts are ready to tackle your questions.

Web Rental property often offers larger deductions and tax benefits than most investments. Web Up to 25 cash back Constructing a Home You Will Live In. File with confidence now.

Web If 67 of your personal residence is rented then you can deduct 67 of the mortgage interest property taxes utilities internet etc. Web Dear Sunny Youd like to refinance to get a rental property deduction. You can also depreciated 67.

The home mortgage deduction is one of the most popular deductions. If you are married filing separately you can only deduct. You would need to take.

Ad No Appointment No Waiting No Hassle. This can make a. The mortgage interest on your rental.

Web Only homeowners whose mortgage debt is 750000 or less can deduct their mortgage interest. When you include the fair market value of the property or services in your rental income you can deduct that same amount as a rental expense. Many of these are overlooked by landlords at tax time.

Keep Certified Online Experts in Any Field at Your Fingertips. Ask a Bar-Certified Rental Lawyer Online Now. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1.

If you are single or married and. Web Generally deductible closing costs are those for interest certain mortgage points and deductible real estate taxes. Connect with our CPAs or other tax experts who can help you navigate your tax situation.

Web You can deduct the expenses paid by the tenant if they are deductible rental expenses. Thats possible but your losses may be limited. Web Up to 25 cash back You cant deduct as interest any expenses you pay to obtain a mortgage on your rental property.

How Much Can You Earn From A Rental Property

Which Accounts Should I Use How To Choose Between Roth Ira 401k And Others Start Investing Series By Adam Fortuna Minafi Medium

Great Neck 2019 03 01 By The Island 360 Issuu

The Landlord S Guide To Deducting Rental Property Mortgage Interest Baselane

Rental Property Tax Deductions The Ultimate Tax Guide 2021 Edition Stessa

Calameo High Country Shopper 10 01 14

Deduction Of Mortgage Interest On Rental Property

Can You Deduct Mortgage Interest On A Rental Property

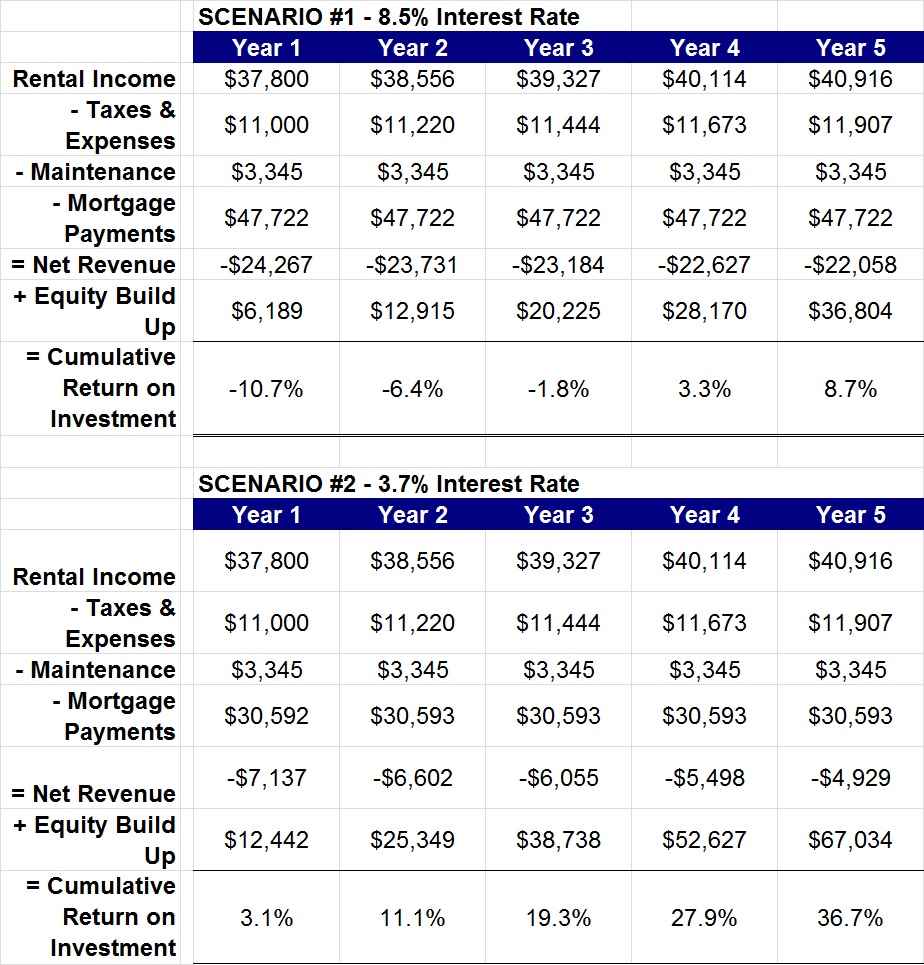

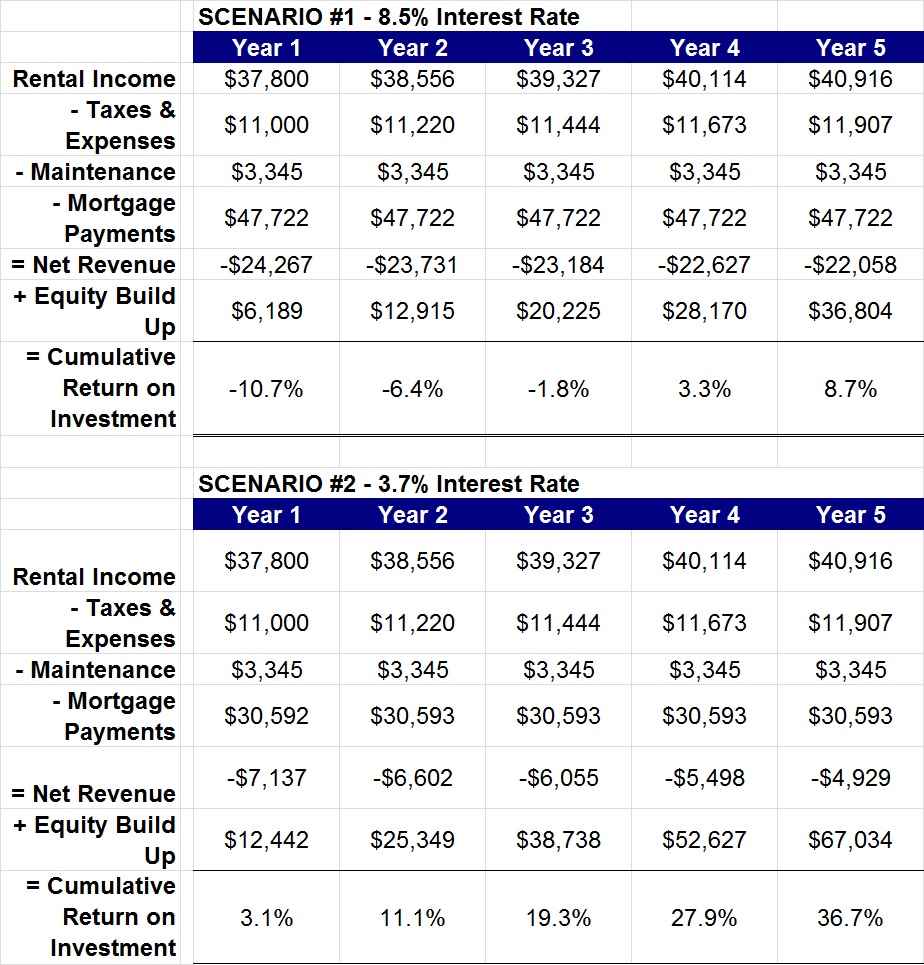

The Hidden Value In Rental Properties When Rates Are Low Dave The Mortgage Broker

Mortgage Interest Deduction Faqs Jeremy Kisner

Everybody Should Buy More Rental Property

Is Interest Paid On Investment Property Tax Deductible

Landlords Face A Tax Rate Of Up To 66 On Rental Profits Daily Mail Online

Difference Between Mortgage Interest Deductible For A Rental Owner Occupied

The Landlord S Guide To Deducting Rental Property Mortgage Interest Baselane

Business Succession Planning And Exit Strategies For The Closely Held

Is Your Mortgage Considered An Expense For Rental Property